Michael RaceBusiness reporter

Getty Images

Getty Images

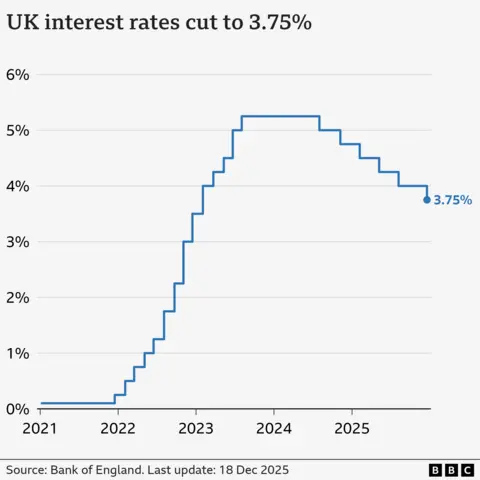

Interest rates have been cut to 3.75%, the lowest level in almost three years, but further reductions are set to be a "closer call", the Bank of England has said.

In a knife-edge vote, policymakers voted 5-4 in favour to lower rates from 4% reflecting concerns over rising unemployment and weak economic growth.

The Bank said rates were "likely to continue on a gradual downward path", but warned judgements on further cuts next year would be more contested.

Inflation is now expected to fall "closer to 2%" - the Bank's target - next year, which is earlier than previous forecasts. However, the economy is predicted to see zero growth in the final few months of this year.

The decision to lower borrowing costs from 4% was widely expected, after figures this week showed inflation, the rate prices rise at, slowed further to 3.2% in the year to November.

"We still think rates are on a gradual path downward but with every cut we make, how much further we go becomes a closer call," said the Bank's governor, Andrew Bailey.

While the cut is likely to be good news for people looking to borrow cash or secure a mortgage, savers could see a reduction on their returns.

About 500,000 homeowners have a mortgage that "tracks" the Bank of England's rate, and Thursday's cut is likely to mean a typical reduction of £29 in monthly repayments.

Homeowners on standard variable rates are also likely to see lower payments, although the vast majority of mortgage customers have fixed-rate deals so are not immediately affected by the latest decision.

Kayleigh Taylor told the BBC she hoped for a cut as her mortgage repayments had gone up £1,000 a month when she previously remortgaged.

"When we bought the property that we're in now, because of the circumstances we had to lock in for just a year. So then we were forced to re-mortgage and it was at the worst time," she said.

The family are due to remortgage next year, but might look to move from their current home in Billericay, Essex, to a bigger property if rates continue to fall.

"We're in a little bit of a limbo as to whether we remortgage and stay where we are, or in an ideal world we would look to move to somewhere more rural and a little bit less built-up area," she said.

Kayleigh Taylor

Kayleigh Taylor

Kayleigh Taylor hoped to see rates come down as she looks to remortage

The Bank said that, following the tax and spending policies announced in last month's Budget and easing oil and gas prices, inflation was likely to fall close to 2% in the spring/summer of next year. Previously it did not expect this to happen until 2027.

Chancellor Rachel Reeves announced the government would cut £150 off household energy bills in the Budget, as well as freezes to fuel duty, medical prescriptions and rail fares.

However, the Bank said weaker economic growth in November had led it to expect zero growth for the final few months of this year.

The government has made growing the economy its main priority as part of its efforts to boost living standards.

The Bank said information gathered from businesses around the country suggested a "lacklustre economy", with firms concerned by the speculation ahead of the Budget.

It said consumers remained "cautious and keenly focused on value for money", adding that food shops were "smaller than usual".

"Some supermarkets have been concerned that the Budget will dampen spending on Christmas food and drink, but discounters say that early sales of lowered priced seasonal food are solid so far," it added.

The Christmas period is the main money-making time of the year for restaurants and bars, but the Bank said hospitality businesses were trying to cut down on expenditure and "contain price increases as far as possible, given fragile demand and rising concerns about affordability for consumers".

Latest figures showed the price of food was the main driver behind November's drop in inflation.

The inflation rate has fallen in recent months, but this drop does not mean that prices are falling, rather they are rising at a slower rate.

Mr Bailey reiterated that the Bank believed inflation had passed its peak.

Ruth Gregory, deputy chief UK economist at Capital Economics, said with inflation set to fall further than the Bank expected, analysts believed a rate cut in February was possible.

She added it was also possible that "rates will fall to 3% in 2026 rather than to the low of 3.5% currently priced into the market".

Reacting to the Bank's decision, the chancellor said it was the "sixth interest rate cut since the election - that's the fastest pace of cuts in 17 years, good news for families with mortgages and businesses with loans".

But shadow chancellor Mel Stride said while lower interest rates would be "welcome news for many families", the cut reflected "growing concerns about the weakness of our economy".

"The economic mismanagement of Rachel Reeves has left the Bank of England with an impossible dilemma, balancing high inflation against a fragile economy."

The Bank, which is independent of the government, sets interest rates in an attempt to try to keep consumer price rises under control.

The theory behind increasing interest rates to tackle inflation is that by making borrowing more expensive, more people will cut back on spending and that leads to demand for goods falling and price rises easing.

But it is a balancing act, as high interest rates can harm the economy as businesses hold off from investing in production and jobs.

Get our flagship newsletter with all the headlines you need to start the day. Sign up here.

.png)

2 hours ago

3

2 hours ago

3

English (US) ·

English (US) ·