Becky MortonPolitical reporter

PMQs: Tory leader pushes PM over tax measures in next week's Budget

Conservative leader Kemi Badenoch has said the government's Budget is unravelling before it has even been delivered, after the chancellor backed away from raising income tax rates.

Ministers had given strong indications it was planning to increase the tax - which would break an election pledge - but last week government sources said Rachel Reeves had decided against the move after better-than-expected economic forecasts.

During Prime Minister's Questions, Badenoch pressed Sir Keir Starmer over whether the government would "break another promise" instead by freezing income tax thresholds.

The PM refused to rule this out, saying the chancellor would set out her plans in next week's Budget.

Describing the situation as a "shambles", Badenoch accused the government of floating the idea of increasing income tax rates only to "U-turn".

"This is the first Budget to unravel before it's even been delivered," she told the House of Commons.

"The chancellor's cluelessness, I'm afraid, is damaging the economy now."

Badenoch also highlighted comments from the chancellor in her Budget last year, when Reeves said: "I am keeping every single promise on tax that I made in our manifesto", adding that she would not extend the freeze on income tax and National Insurance thresholds because this "would hurt working people".

The Tory leader asked the PM to confirm the government would not break this promise and continue the freeze on income tax thresholds.

But Sir Keir dodged the question, only saying the Budget would focus on cutting NHS waiting lists, debt and the cost-of-living.

"What we won't do is inflict austerity on the country as they did. What we won't do is inflict a borrowing spree like [Conservative prime minister] Liz Truss did," he added.

In response, Badenoch said it was "quite clear" the government was planning to freeze thresholds.

"If [the chancellor] breaks such a clear promise, how can the public trust a word that she says next week?"

Reeves will deliver her Budget in the House of Commons on 26 November, and Badenoch will give the immediate response for the opposition.

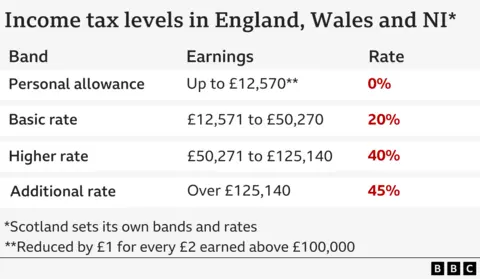

In Labour's 2024 general election manifesto, the party promised it would "not increase taxes on working people, which is why we will not increase National Insurance, the basic, higher or additional rates of income tax, or VAT".

The freeze on income tax thresholds - the level people start paying tax or have to pay higher rates - was introduced under the Conservatives in April 2023 and is due to expire in 2028.

While an extension of the freeze would not break the strict letter of the manifesto promise, it would mean some people's tax bills go up.

This is because more people would be dragged into a higher tax band, or have to pay tax on their income for the first time, if they get a pay rise.

Extending the freeze on income tax and National Insurance thresholds by two years could raise £8.3bn a year, according to the Institute for Fiscal Studies.

It would mean those on the lowest incomes are increasingly subject to tax, with the think tank estimating that someone on a minimum wage would be liable to pay income tax if they worked just 18 hours a week.

In the months running up to the Budget, ministers had repeatedly given strong indications that income tax rates would go up.

As recently as last week, Reeves had told the BBC sticking to Labour's manifesto commitments would require "deep cuts in capital spending".

In October, Sir Keir had declined to repeat his previous promises not to increase key taxes during Prime Minister's Questions.

However, last Friday it emerged that Reeves had decided not to go ahead with the move, after estimates suggested a gap in the public finances was £10bn smaller than previously thought.

Ahead of every Budget, the chancellor submits their plans to the Office for Budget Responsibility (OBR), which then make forecasts on whether the government will spend more money than it raises and whether the economy will grow or shrink.

A proposal to increase income tax rates by 2p, while cutting National Insurance by the same amount, was sent to the OBR as an option earlier this month to be costed, to help fill what was then a £30bn gap in the public finances.

Newer assessments from the OBR appear to have increased the projected strength of wages and tax receipts in the coming years and offset several billion pounds of that gap, taking it closer to £20bn.

Many Labour MPs were also nervous about breaking an election promise, which would have influenced the chancellor's decision.

Sign up for our Politics Essential newsletter to read top political analysis, gain insight from across the UK and stay up to speed with the big moments. It'll be delivered straight to your inbox every weekday.

.png)

1 hour ago

3

1 hour ago

3

English (US) ·

English (US) ·