Emma SimpsonBusiness correspondent

BBC

BBC

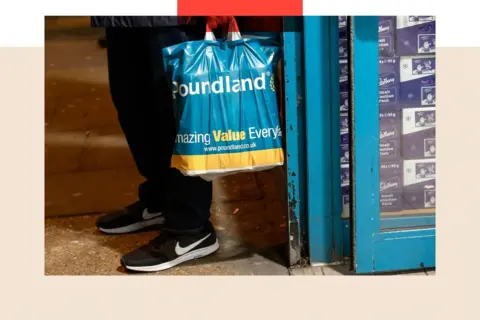

The residents of Peckham in south London have just lost their Poundland store, which closed this week after 11 years of trading.

"Everyone comes in here, it's very cheap. I buy stuff for my kids, snacks, toiletries," says passing shopper Becky Cullen, staring at the empty shop. "It was always busy... Where are we going to shop now?"

The store was on Rye Lane, a lively high street where Caribbean grocers stack yams next to beauty and phone repair shops. There are bars, cafes and the odd hip vintage shop. But Peckham still has high levels of deprivation and as such it is just the sort of place where a bargain shop should be booming in a cost-of-living crisis.

Instead Poundland has found itself running a store closure programme as it tries to secure its future on the high street.

Rye Lane in south London - a lively, multicultural high street - is losing its pound shop, after 11 years of trading

More than 100 of its shops have either shut or been earmarked for closure since the summer. That's after the business was sold in June for a nominal £1 amid "challenging trading conditions".

It does have a turnaround plan but by the end of the process, Poundland expects to end up with between 650 and 700 shops, compared with the 800-odd it had at the start of this year.

Elsewhere on UK high streets, the Original Factory shop is struggling and has shut at least 22 shops. Maxideal, a small discount chain, has closed altogether. And B&M Bargains, one of the UK's biggest discount chains, has launched a turnaround plan due to weak sales.

These places should in theory be the destinations of choice for people who are trying to spend less on everyday goods, or trading down from more expensive shops.

So why - in an age where so many of us are feeling the financial pinch - are some of these budget shops that are household names having such a tough time?

Are shoppers 'outsmarting' budget stores?

One thing is clear - we're not falling out of love with budget shopping, far from it. But the way we are budget shopping does appear to have changed.

"[Shoppers] are outsmarting the budget shops," says retail expert Catherine Shuttleworth, whose company, Savvy, gathers insight on shopper behaviour. "[They're doing this] by saying, 'These are things I'm going to buy from you.'

"They know their prices inside out."

Sometimes shoppers will take a photo of a deal on their phone and send it to their friends and family, Shuttleworth says, so that everyone is up-to-date with the latest prices.

But that's not the only challenge. Budget chains are also experiencing a formidable combination of rising costs and competition.

Bloomberg via Getty Images

Bloomberg via Getty Images

Poundland was sold in June for a nominal £1 amid 'challenging trading conditions'

All big retailers have faced a substantial increase in employer costs because of last year's Budget, but it's more difficult when you're selling the cheapest products because there's less wiggle room to absorb the extra costs, or to pass them on to customers.

For pound shops in particular, it's even harder to make the business model work today, as a pound isn't what it used to be.

After inflation, selling a product for £1 in 1990, when Poundland began, is the equivalent of selling it for 40p today.

The entrepreneur who cracked the model

Chris Edwards, a businessman from Yorkshire, has spent more than 50 years working in retail's bargain basement. He and his son were the team behind Poundworld, which they sold for £150m 10 years ago.

In 2019, they started a new chain, OneBelow, selling everything for £1 or less - but three years later they had to change tactics. It's now called OneBeyond, with almost everything at £1 or above.

"We realised the pound game wasn't going to work any more," he says. "What tipped us over the edge was the [post-pandemic] shipping crisis, when we couldn't get containers through and the cost of freight was ridiculous."

'We realised the pound game wasn't going to work any more,' says Chris Edwards

But Mr Edwards says his business model still works: in his view, it comes down to experience, negotiating skill and getting the mix of products just right.

His Croydon store, with a colourful Christmas aisle, is bustling on a weekend visit with queues for the tills as shoppers stock up on mouthwash, washing up liquid, sweets and batteries.

"We know what the customer is going to buy before the customer knows they're going to buy it," he declares.

As for making economics stack up, he says sometimes he is able to secure cheap prices on UK stock from big-name brands but when he can't he sacrifices profits in order to attract shoppers.

Corbis via Getty Images

Corbis via Getty Images

Budget shops place a huge value on the Christmas period, says retail expert Catherine Shuttleworth

"We've got a constant flow of containers from China and we can negotiate very keen prices," he says.

So, if customers enter a store to buy a Coca-Cola, they may also pick up a product imported directly from China, where he can make a bit of "extra margin".

When the numbers unravel

If you don't get budget retail right though, the numbers can quickly unravel.

The father and son duo grew Poundworld into a chain of more than 300 shops, before selling it in 2015 to an American investor. But it soon collapsed, disappearing from the high street three years later.

"They just didn't understand the discount business," he argues. "They tried to sell other things but not in a controlled way like we do it."

Wilko also lost its way, tipping into administration in 2023 with the loss of thousands of jobs.

Poundland avoided collapsing into administration this year, after a dreadful period of trading, much of it of its own making. The business had drifted further and further from its core offer - lots of products for £1 - and was selling them instead at a wide range of different prices. Its owners, the Warsaw-listed Pepco Group, also put Pepco clothing into Poundland stores, which wasn't popular with shoppers.

"Poundland forgot what they were. The key to budget shops is keeping them simple," says Catherine Shuttleworth.

But she believes Poundland can find its way back, providing they return to basics. The company has already simplified its pricing and says it is making good progress with a turnaround plan.

This has meant closing 57 unprofitable stores and negotiating steep rent cuts with landlords, where it can. Another 48 shops are being shut as these landlords have decided to take back the leases and find new occupiers instead.

The main budget chains now have 3,400 shops across the UK, according to data analytics firm, Geolytix. The number of them more than doubled between 2009 and 2015 - but numbers have risen only slightly since then.

Back in 2009 the UK was in the teeth of a recession, following the global financial crisis. Woolworths had just disappeared, giving rivals, such as Poundland, the chance to fill the gaps, taking advantage of cheap rents. And shoppers, everywhere, were after bargains.

Getty

Getty

High street shopping has evolved since the 1970s, when shops like Woolworths were hugely popular

Discount supermarkets Aldi and Lidl also grew rapidly during this period, luring millions of customers away from the established grocers with cheaper prices. Savvy shopping became cool, even for those on higher incomes.

By 2019, much of the budget store growth was happening in out-of-town locations and retail parks, a trend accelerated by the pandemic. For instance, B&M, Home Bargain and The Range shops have large garden centres and sell bulkier items which are easier to collect by car.

But budget shops are having a much tougher time during this cost-of-living crisis.

Not only have the supermarkets upped their game with sharper prices and loyalty cards to keep shoppers on board, but the sector also now has the rise of "extreme discounting" online to contend with.

From China to TikTok: growing competition

Today, Chinese players Shein and Temu are nibbling away on the budget shops' patch by selling ultra-cheap products direct to consumers. There's also AliExpress, another Chinese-based retailer, which operates as a global online market connecting shoppers with sellers.

"AliExpress had a huge boost in usership last year, from sponsoring the Euros, and it's growing," says Nick Carroll, director of retail insight from Mintel.

Sales figures are hard to come by, but Mintel data suggests 30% of online shoppers in the UK shopped with Temu in the year to September 2025, while 14% shopped with AliExpress and 3% with DHGate, another Chinese marketplace, in the same period.

AFP via Getty Images

AFP via Getty Images

Chinese brands like Shein sell products in bulk from their huge factories - inside one of their enormous factories

Amazon has also got in on the act by launching its own ultra-low-cost shopping section, Amazon Haul.

"If you look at those products, they look very similar to what you'd find on Temu etc, so if Amazon's doing a reaction to something in the market, you know it's notable," says Carroll.

"There's a lot more coming into that space. So this sort of wave of low-cost influence from outside of the UK isn't slowing down, and I think there's much more to come."

There are also new selling platforms like TikTok Shop, Catherine Shuttleworth points out, where you can find people advertising anything from sweets and toilet paper to pillows. A seller on TikTok can sell toilet paper cheaper than a high street shop, she adds, because there are no overheads, no staff, and probably very little stock.

"So long as they [shoppers] can get it at the right price, the right place and at the right time, they will go anywhere to do that," she says.

"It's not just the standard retailer they used to go to - it could be anybody."

Getty Images

Getty Images

On selling platforms like TikTok Shop, you can find people advertising anything from sweets, pillows and toilet paper to beauty products

The danger for traditional budget shops is that they will no longer be seen as being the cheapest in the market.

All this coupled with a "cost-of-business crisis" - caused by recent rises in the minimum wage and in employers' national insurance contributions, among other things - could shake out the weaker players, thinks Ms Shuttleworth.

"You've got to be the best of the best in whichever segment, whether you're at the top, the middle or the bottom, and it's super-super-competitive and one of the problems here, is there's so many people in that market.

"But I think what will happen in this sector is that there has to be some consolidation, and the stronger players will win out."

Lessons from the outliers

It's not all bad news, of course. Some chains have been doing very well recently.

The Range has continued to expand, opening 60 standalone stores this year, after acquiring the DIY chain Homebase out of administration. Home Bargains is still thriving and opening new stores, too.

Savers, which sells mostly toiletries and cosmetics, but some other goods too, has also expanded in recent years. The BBC has been told it is moving into Poundland's Peckham store space.

OneBeyond has grown to 132 stores, but expansion has slowed. Chris Edwards blames the government, arguing it has made things harder by piling on extra costs.

"Every period has its own challenges... and we just have to do our own thing."

As for current trading, he says, he is getting by. "We're not saying we're earning fortunes of money. We're not - but we're paying our way, and we're just waiting for better times."

Getty Images

Getty Images

'We can break even all year if we have a good Halloween and a good Christmas'

His focus now, along with almost every other retailer, is Christmas trading.

"It means everything... we can break even all year if we have a good Halloween and a good Christmas," he says.

Catherine Shuttleworth reckons that's where good budget retailers come into their own, as shoppers often turn to these aisles for big events. "They're a great place to go and deck your house out."

But also, they may be the only place many households can afford to shop. Not everyone likes to shop online, or wants to make the trip to a retail park.

"For some people, budget shopping is a hobby," Shuttleworth says, "but for others it's an absolute necessity."

BBC InDepth is the home on the website and app for the best analysis, with fresh perspectives that challenge assumptions and deep reporting on the biggest issues of the day. You can now sign up for notifications that will alert you whenever an InDepth story is published - click here to find out how.

.png)

2 hours ago

2

2 hours ago

2

English (US) ·

English (US) ·