Soutik Biswas and Nikhil InamdarBBC News

Getty Images

Getty Images

Trump has stunned the tech world by announcing an up to 50-fold hike in the cost of skilled worker permits

Panic, confusion and then a hasty White House climbdown - it was a weekend of whiplash for hundreds of thousands of Indians on H-1B visas.

On Friday, US President Donald Trump stunned the tech world by announcing an up to 50-fold hike in the cost of skilled worker permits - to $100,000. Chaos followed: Silicon Valley firms urged staff not to travel outside the country, overseas workers scrambled for flights, and immigration lawyers worked overtime to decode the order.

By Saturday, the White House sought to calm the storm, clarifying that the fee applied only to new applicants and was a one-off. Yet, the long-standing H-1B programme - criticised for undercutting American workers but praised for attracting global talent - still faces an uncertain future.

Even with the tweak, the policy effectively shutters the H-1B pipeline that, for three decades, powered the American dream for millions of Indians and, more importantly, supplied the lifeblood of talent to US industries.

That pipeline reshaped both countries. For India, the H-1B became a vehicle of aspiration: small-town coders turned dollar earners, families vaulted into the middle class, and entire industries - from airlines to real estate - catered to a new class of globe-trotting Indians.

For the US, it meant an infusion of talent that filled labs, classrooms, hospitals and start-ups. Today, Indian-origin executives run Google, Microsoft and IBM, and Indian doctors make up nearly 6% of the US physician workforce.

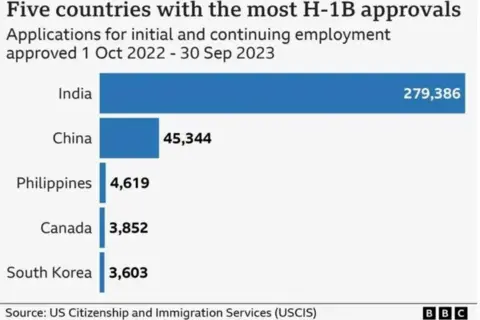

Indians dominate the H-1B programme, making up more than 70% of the recipients in recent years. (China was the second-largest source, making up about 12% of beneficiaries.)

In tech, their presence is even starker: a Freedom of Information Act request in 2015 showed over 80% of "computer" jobs went to Indian nationals - a share industry insiders say hasn't shifted much.

The medical sector underlines the stakes. In 2023, more than 8,200 H-1Bs were approved to work in general medicine and surgical hospitals.

India is the largest single source of international medical graduates (who are typically in US on H-1B visas) and make up about 22% of all international doctors. With international doctors forming up to a quarter of US physicians, Indian H-1B holders likely account for around 5-6% of the total.

Experts say pay data shows why Trump's new $100,000 fee is unworkable. In 2023, the median salary for new H-1B employees was $94,000, compared with $129,000 for those already in the system. Since the fee targets new hires, most won't even earn enough to cover it, say experts.

"Since the latest White House directive indicates that the fee would only apply to new H-1B recipients, this is more likely to cause medium and long-term labour shortages instead of immediate disruption," Gil Guerra, an immigration policy analyst at the Niskanen Center, told the BBC.

India may feel the shock first, but the ripple effects could run deeper in the US. Indian outsourcing giants such as TCS and Infosys have long prepared for this by building local workforces and shifting delivery offshore.

The numbers tell the story: Indians still account for 70% of H-1B recipients, but only three of the top 10 H-1B employers had ties to India in 2023, down from six in 2016, according to Pew Research.

To be sure, India's $283bn IT sector faces a reckoning with its reliance on shuttling skilled workers to the US, which accounts for over half its revenue.

IT industry body Nasscom believes the visa fee hike could "disrupt business continuity for certain onshore projects". Clients are likely to push for repricing or delay projects until legal uncertainties are cleared, while companies may rethink staffing models - shifting work offshore, reducing onshore roles and becoming far more selective in sponsorship decisions.

Indian firms are also likely to pass on the increased visa costs to US clients, says Aditya Narayan Mishra of CIEL HR, a leading staffing firm.

"With employers reluctant to commit to the heavy cost of sponsorship, we could see greater reliance on remote contracting, offshore delivery and gig workers."

The broader impact on the US could be severe: hospitals facing doctor shortages, universities struggling to attract STEM students, and start-ups without the lobbying muscle of Google or Amazon are likely to be hit hardest.

"It [visa fee hike] will force US companies to radically change their hiring policies and offshore a significant amount of their work. It will also ban founders and CEOs coming to manage US-based businesses. It will deal a devastating blow to US innovation and competitiveness," David Bier, director of immigration studies at the Cato Institute, told BBC.

San Francisco Chronicle via Getty Images

San Francisco Chronicle via Getty Images

Indians dominate the H-1B programme, making up more than 70% of recipients

That anxiety is echoed by other experts. "The demand for new workers in fields like tech and medicine [in US] is projected to increase (albeit in uneven ways), and given how specialised and critical these fields are, a shortage that lasts even a few years could have a serious impact on the US economy and national well-being," says Mr Guerra.

"It will likely also incentivise more skilled Indian workers to look at other countries for international study and have a cascading effect on the American university system as well."

The impact, in fact, will be felt most sharply by Indian students, who make up one in four international students in the US.

Sudhanshu Kaushik, founder of the North American Association of Indian Students, which represents 25,000 members across 120 universities, says the timing - just after September enrolments - has left many new arrivals stunned.

"It felt like a direct attack, because the fees are already paid, so there's a big sunk cost of anywhere between $50,000 and $100,000 per student - and the most lucrative route to entering the American workforce has now been obliterated," Mr Kaushik told the BBC.

He predicts the ruling will hit US university intake next year, as most Indian students opt for countries where they can "put down permanent roots".

For now, the full impact of the tax hike remains uncertain.

Immigration lawyers expect Trump's move to face legal challenges soon. Mr Guerra warns that the fallout could be uneven: "I expect the new H-1B policy will bring a number of negative consequences for the US, though it will take some time to see what those may be."

"For example, given that the executive order allows for certain companies to be excepted, it could be possible that some heavy H-1B users such as Amazon, Apple, Google, and Meta will find a way to be exempted from the H-1B fee policy. If they all get exemptions, however, this would largely defeat the purpose of the fee."

As the dust settles, the H-1B shake-up looks less like a tax on foreign workers and more like a stress test for US companies - and the economy. H-1B visa holders and their families contribute roughly $86bn annually to the US economy, including $24bn in federal payroll taxes and $11bn in state and local taxes.

How companies respond will determine whether the US continues to lead in innovation and talent - or cedes ground to more welcoming economies.

.png)

2 months ago

14

2 months ago

14

English (US) ·

English (US) ·