Getty Images

Getty Images

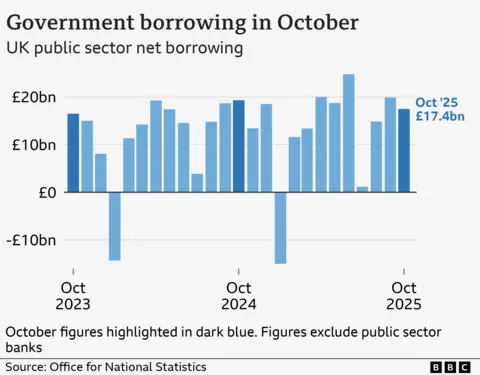

UK government borrowing was more than £2bn higher than expected last month according to the latest official figures.

Borrowing - the difference between public spending and tax income - was £17.4bn in October, down from £19.2bn in the same month last year, the Office for National Statistics (ONS) said.

Analysts had expected the figure to be £15bn, slightly higher than the Office for Budget Responsibility's (OBR) March forecast of £14.4bn.

ONS chief economist Grant Fitzner said while borrowing was down compared with the same month last year, it was "still the third-highest October figure on record in cash terms".

"While spending on public services and benefits were both up on October last year, this was more than offset by increased receipts from taxes and National Insurance contributions," he said.

In the financial year to October, borrowing was £116.8bn, which was £9bn more than the same seven-month period in 2024. It was the second-highest borrowing for April to October since records began in 1993, after 2020.

The borrowing figures come less than a week before Chancellor Rachel Reeves unveils her Budget, and she has previously confirmed both tax rises and spending cuts are on the table.

Chief Secretary to the Treasury James Murray said at the moment £1 of every £10 in taxpayer money was spent on interest on national debt.

"That money should be going to our schools, hospitals, police and armed forces," he said.

"That is why we are set to deliver the largest primary deficit reduction in both the G7 and G20 over the next five years - to get borrowing costs down."

Shadow chancellor Sir Mel Stride said borrowing so far this financial year had been the highest on record besides the pandemic.

"If Labour had any backbone, they would control spending to avoid tax rises next week," he said.

James Smith from investment bank ING said the figures would not be welcomed by the chancellor ahead of her Budget, but her fiscal rules were about what happens later this decade, rather than today.

"So today's data is not helpful, it shows that the government is borrowing more than expected, but it doesn't necessarily change the decisions next week," he told BBC's Today programme.

Separate data from the ONS showed that over the month of October retail sales fell by 1.1% - the first monthly drop since May.

"Supermarkets, clothing stores and online retailers all saw slower sales, with feedback from some retailers that consumers were waiting for November's Black Friday deals," Mr Fitzner said.

Ruth Gregory, deputy chief UK economist at Capital Economics, said that together the latest government borrowing and retail sales figures painted a "pretty grim picture" of the economy.

Higher local authority spending had been "a key source of the overshoot" in government borrowing for the seven months of the financial year, she said, but slow growth in tax receipts had also contributed.

"This only underscores the generally poor fiscal picture facing the chancellor as she looks set to tighten fiscal policy in the forthcoming Budget," Ms Gregory said.

However, she noted the monthly fall in retail sales "isn't quite as bad as it looks" as it comes off the back of four consecutive months of increases, but also said that consumer confidence had declined, which "suggests that consumers aren't exactly chipper at the moment".

.png)

1 hour ago

2

1 hour ago

2

English (US) ·

English (US) ·